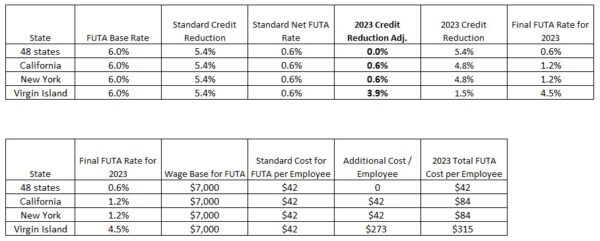

Along with New York and the U.S. Virgin Islands, California is facing a reduction in Federal Unemployment Tax Act (FUTA) credit for 2023, which means employers in California pay higher FUTA taxes retroactively in January 2024 for wages paid in 2023 due to the state’s outstanding federal loans. Several states, including California, experienced a FUTA Credit Reduction of 0.3% for 2022, and will be subject to an additional 0.3% credit reduction for 2023.

What Is the Federal Unemployment Tax Act (FUTA)?

The Federal Unemployment Tax Act (FUTA), passed in 1939, established a federal payroll tax to help fund and insure state unemployment benefits across the United States. This base federal payroll tax is 6% on the first $7,000 each employee makes in a year, which the employer is responsible for paying. Employers in most states are provided a Credit of 5.4% to this 6% FUTA rate. The results in a rate of 0.6%.

State governments are also responsible for collecting unemployment taxes from employers and providing state unemployment funds for workers who need to collect unemployment insurance due to losing their jobs. However, sometimes state governments on their own do not have the funds needed to pay out unemployment compensation to everybody who needs to claim it. In this case, states must borrow from the federal fund.

During the COVID-19 pandemic, many states needed to borrow from the federal government to ensure that unemployed workers could continue to access the unemployment benefits they needed to provide for themselves and their families.

This left some states with outstanding federal loans leading to a credit reduction and an adjusted higher net FUTA tax rate on employers. The adjusted higher net rate is calculated retroactively for the previous year and employers are expected to pay in January of the following year.

Understanding California’s 2023 FUTA Credit Reduction

According to the US Department of Labor, California was one of several states that did not pay back its federal unemployment loans by the November deadline. FUTA tax credit, resulting in the state losing a portion of the FUTA Credit retroactively for 2023. As a result, California is experiencing an additional 0.3% in their FUTA credit reduction rate, which means employers in 2024 will have to pay a higher FUTA rate of 0.6% total, retroactively for 2023. The Credit Reduction increases each year the outstanding loan balance is not paid. A Credit Reduction results in the net tax rate increasing.

According to IRS regulations, any increased FUTA tax liability due to a credit reduction is considered incurred in the fourth quarter of the relevant calendar year and is due by January 31st of the following year. California employers will retroactively pay an additional 0.6% on FUTA taxable wages for 2023 when filing the 2023 Form 940.

How the FUTA Tax Rate is Calculated

Beginning on January 1st of every calendar year, FUTA is calculated on the first $7,000 wages of every eligible employee. The default credit for states is 5.4%, which when subtracted from the base tax rate of 6% yields a default net rate of 0.6%.

However, as a result of California’s 2023 FUTA credit reduction, the state’s default credit is being reduced by an additional 0.3% (for a total of 0.6%) to 4.8%, resulting in an adjusted net FUTA tax rate for 2023 of 1.2%—an increase of 0.6%. 6.0 – 5.4 equals 0.6%. A retroactive credit reduction of 0.6% increases the net tax rate to 1.2%.

What California’s 2023 FUTA Credit Reduction Means for Employers

California employers are expected to pay the adjusted net FUTA tax rate for 2023 retroactively for the year by January 31, 2024.

What this means is that in January, employers filing Form 940 for 2023 will be required to pay a total of 1.2% tax on the first $7,000 of wages per eligible employee instead of California’s original 0.6% FUTA tax rate for 2023.

For example:

An employer with 50 employees in California in 2023 would normally owe $42 per employee—a 0.6% FUTA tax due on each employee’s first $7,000 of the calendar year—which comes to $2,100 in total for the business. However, California’s FUTA credit reduction increases the tax to 1.2%, or $84 per employee, or $4,200 in total for the business.

To help employers understand the impact of a FUTA credit reduction, the IRS has produced a brief video explaining how FUTA works and how to report the credit reduction properly on Form 940.

As an employer, it is important for you to stay informed about changes to FUTA tax rates, state unemployment taxes, and the overall financial health of your state’s unemployment trust fund. If you have any questions about the specific implications of California’s FUTA credit reduction for your business or need help developing strategies to navigate the potential challenges of an increased state unemployment tax, we encourage you to consult with tax professionals or legal advisors.

According to the United States Department of Labor, as of the end of the 3rd quarter in 2023, the state of California has an outstanding Title XII loan balance of over $18 billion. It is unlikely this federal loan balance will be paid in 2024. Employers should budget and prepare for an additional credit reduction next year as well.

Thank you for choosing California Payroll as your payroll and HR Technology solutions provider. This information is provided as a courtesy and should not be taken as legal or tax guidance for business owners or payroll professionals. If you have any further questions about California’s FUTA credit reduction, we encourage you to seek advice from a qualified CPA, tax attorney, or tax advisor.

FAQs

What is the Federal Unemployment Tax Act (FUTA) and how does it impact California businesses?

The Federal Unemployment Tax Act (FUTA) is a federal payroll tax that helps fund and insure state unemployment benefits. Employers in California are responsible for paying a 6% FUTA tax on the first $7,000 each employee makes in a year. However, due to outstanding federal loans, California is facing a reduction in FUTA credits in 2023, resulting in higher FUTA taxes for employers in 2024.

Why is California experiencing a FUTA credit reduction?

California, along with other states, borrowed funds from the federal government during the COVID-19 pandemic to provide unemployment benefits to workers. As a result, California has outstanding federal loans and did not pay them back by the November deadline. This leads to a credit reduction, increasing the net FUTA tax rate for employers.

How is the FUTA tax rate calculated in California?

The default FUTA tax rate in California is 6%, but employers are provided a credit of 5.4%, resulting in a net rate of 0.6%. However, due to the credit reduction, California’s default credit is reduced to 4.8%, resulting in an adjusted net FUTA tax rate of 1.2% for 2023.

What does California's 2023 FUTA credit reduction mean for employers?

Employers in California will be required to pay the adjusted net FUTA tax rate of 1.2% retroactively for 2023 by January 31, 2024. This means they will have to pay a higher tax rate on the first $7,000 of wages per eligible employee when filing Form 940.